Investors Lean Towards Real-World Asset Tokens for 2026 Gains

A recent poll conducted by Stocktwits reveals that a significant 64% of cryptocurrency enthusiasts believe that real-world assets (RWAs) will deliver the strongest returns in 2026. This sentiment indicates a growing trend in the crypto market, where investors are increasingly favoring tokenization of tangible assets over speculative investments like meme coins and privacy-focused tokens.

Insights from the Poll

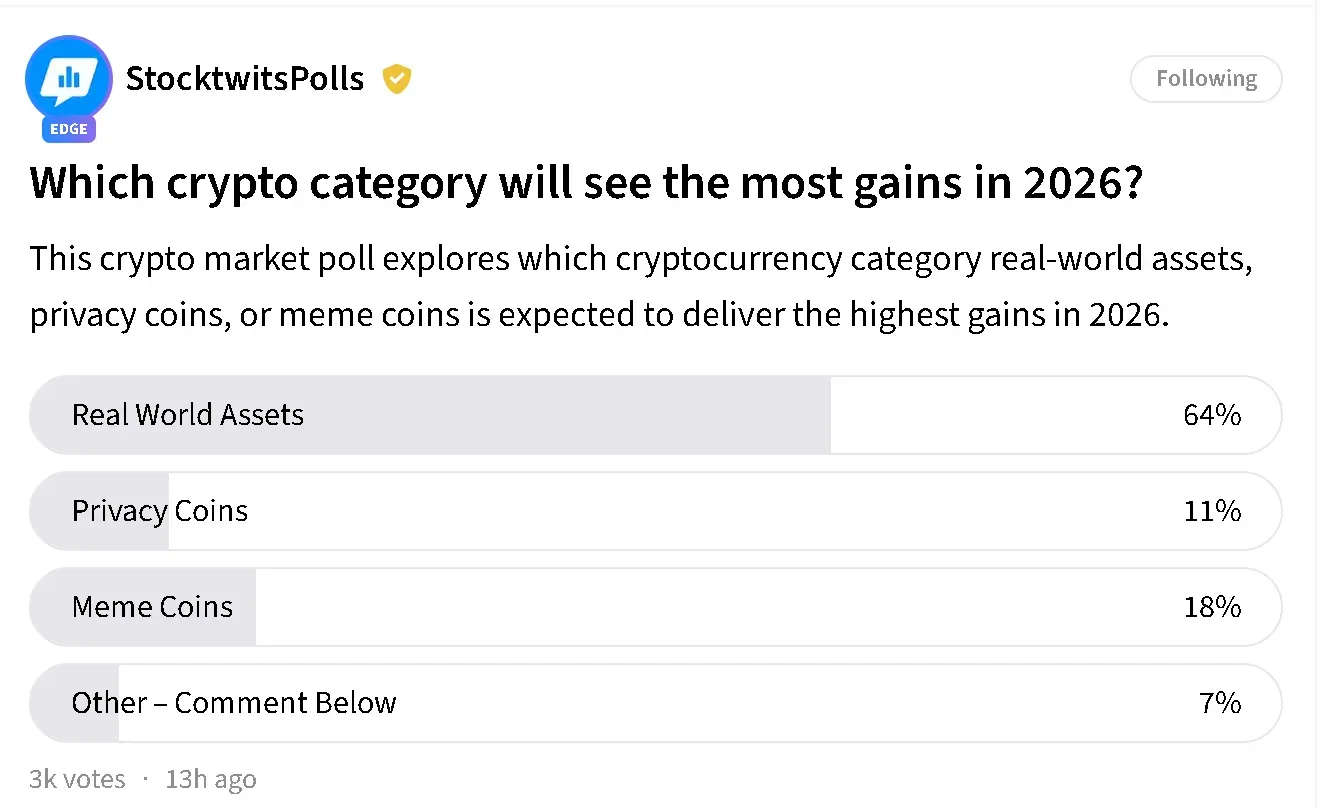

The Stocktwits poll highlights a clear preference among respondents for RWAs, suggesting a robust shift in market dynamics. While 64% indicated that RWAs would lead in returns, only 18% expressed confidence in meme coins, and a mere 11% chose privacy-focused assets. The results underline a collective move away from purely speculative narratives that have dominated the crypto space in recent years.

Results of a Stocktwits poll asking traders which category of cryptocurrencies they expect will outperform in 2026 on January 16, 2026, as of 5:55 a.m. ET | Source: Stocktwits

The Shift Away from Speculation

The crypto market has witnessed a dramatic rise in the number of failed cryptocurrencies, with 2025 alone witnessing an astonishing eightfold increase in failures compared to the previous year. The bulk of these defunct tokens were meme coins, suggesting that the market is becoming wary of heavily speculative assets. This trend aligns with the increasing skepticism surrounding projects lacking robust fundamentals.

Platforms like Pump.Fun and Raydium have made creating meme coins easier than ever, but the October quarter of 2025 brought a significant correction, wiping out nearly 8 million coins and causing a loss of $19 billion. Only a handful, like Pepe and Bonk, managed to survive, implying a clearer signal that investors are now inclined towards more stable, substance-driven assets.

Financial Institutions Embrace Tokenization

What’s driving this newfound enthusiasm for RWAs? A noteworthy factor is the increasing involvement of large financial institutions that are advocating for blockchain-based settlements for various financial instruments. Major players like Grayscale project exponential growth in the RWA sector, which currently represents a mere 0.01% of the global stocks and bonds market. According to their 2026 outlook, this segment is expected to expand dramatically by 2030.

In parallel, venture capital firm a16z identifies RWA growth through native tokenization as one of the fundamental trends shaping the crypto landscape by 2026. This suggests a more systemic acceptance of tokenized assets by mainstream financial entities, driven by advancements in stablecoins and a solid infrastructure for blockchain-based finance.

Bitcoin’s Continued Dominance

While the focus on RWAs is gaining traction, some investors still firmly believe that Bitcoin (BTC) will remain the standout performer. Despite a recent dip of 1.5%, bringing BTC to around $95,500, retail sentiment surrounding the cryptocurrency remains predominantly bullish. However, the discussion around BTC has transitioned from high-level enthusiasm to a more tempered ‘normal’ state, reflecting the shifting priorities in the market.

The Road Ahead

Overall, the Stocktwits poll signifies a pivotal moment in cryptocurrency investing. As RWAs gain momentum, the next phase of crypto gains may be less about hype and more about integrating real-world value through blockchain technology. This evolution could fundamentally reshape how investors approach the market, paving the way for a more sustainable and robust future in digital assets.

The preference for tokenized real-world assets indicates a sophisticated understanding among investors, marking a new era in which financial insights and practicality take precedence over mere speculation. As we move towards 2026, all eyes will be on how this trend unfolds and what it means for the broader financial landscape.