- Bitcoin price gains 3%, reclaiming territories above $83,000 on Wednesday.

- Ongoing Russia-Ukraine talks pushed Polymarket ceasefire odds up 14% in 24 hours.

- BTC open interest climbed 0.4%, breaching the $46 billion mark despite a 22% decline in trading volumes.

Bitcoin bullishness returned with a 3% spike in the last 24 hours, pushing its price back above $83,700 after a brief dip to around $76,000 just a day prior. This resurgence can be largely attributed to the early indications from the latest Consumer Price Index (CPI) data from the United States, which suggest that this upward momentum in Bitcoin may have some legs. Investors seem to be cautiously optimistic, rekindling their interest in the flagship cryptocurrency.

Why is Bitcoin Going Up Today?

On Wednesday, Bitcoin reached as high as $84,539, buoyed by two major catalysts: softer-than-expected inflation data from the US and the easing of geopolitical tensions related to the ongoing conflict between Russia and Ukraine. These developments have created a favorable climate for Bitcoin, particularly among macro-sensitive investors keen on risk assets.

The CPI report released by the US Bureau of Labor Statistics indicated that inflation is cooling more than expected. This positive news reinvigorated interest in Bitcoin, especially among those traders who had previously retreated to safer investments amid inflation-induced fears. The shift could signal a newfound confidence among investors, willing to recapture positions in riskier assets like Bitcoin.

Bitcoin price analysis, March 12

Notably, many investors had initially stepped back from riskier assets following President Donald Trump’s tariff announcements earlier this month, which raised concerns about a more hawkish response from the Federal Reserve. With inflation now appearing more contained, traders are reallocating funds back into Bitcoin, enhancing its short-term recovery prospects.

Russia-Ukraine Talks Push Polymarket Ceasefire Odds Up 14%

In addition to the encouraging CPI data, developments concerning the Russia-Ukraine conflict also played a significant role in Bitcoin’s price recovery. Recent proposals for a 30-day ceasefire, as reported by the BBC, reflect potential progress in the negotiations to de-escalate the war that has persisted for nearly three years. US Secretary of State Marco Rubio outlined this proposal, generating optimism in global markets.

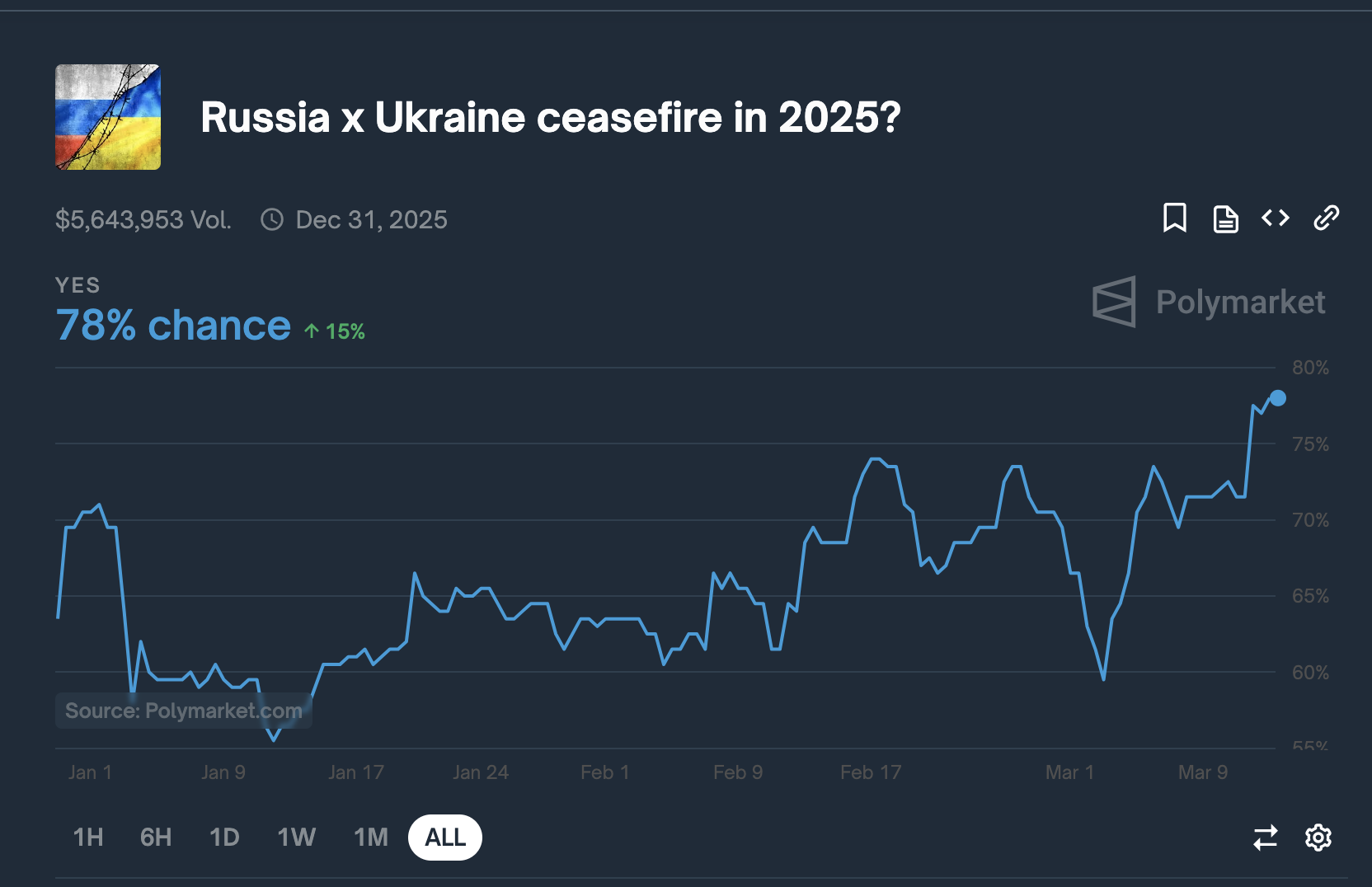

Russia-Ukraine Ceasefire odds surged to 77%, March 12 | Source: Polymarket

In cryptocurrency circles, traders have responded by adjusting their bets on Polymarket—a platform that allows users to make predictions on real-world events. Ceasefire odds rose by a staggering 14%, reflecting growing confidence in a resolution. As of Wednesday, the market was pricing in a 78% chance of a ceasefire being agreed upon by the end of 2025 with trading volumes exceeding $5.6 million.

This uptick in ceasefire expectations signals reduced uncertainty, which typically encourages capital inflows into Bitcoin and other cryptocurrency assets. Even with Bitcoin’s price still hovering below the $85,000 threshold, derivatives market sentiments suggest an increasing level of optimism among speculative traders.

How Would a Russia-Ukraine Ceasefire Influence Bitcoin’s Price?

The emerging discussions surrounding a potential ceasefire have the capability to positively impact Bitcoin’s price for a couple of significant reasons. Firstly, the potential reintegration of Russian energy supplies back into the global markets could alleviate operational costs for Bitcoin miners and blockchain initiatives—especially those utilizing AI technologies. This would inherently boost the overall profitability and sustainability of Bitcoin mining operations.

Moreover, if capital flows from Russia regain access to global cryptocurrency exchanges, this could immensely increase liquidity and institutional investments in the crypto space. As Bitcoin’s accessibility improves, it could validate its role as a digital asset class and bolster its long-term gains.

The early data from Bitcoin derivatives markets indicates that short-term traders are increasingly positioning themselves for a bullish move, reflecting market optimism about Bitcoin’s price trajectory.

Bitcoin Price Outlook: Derivatives Market Data Hints at Prolonged BTC Rally

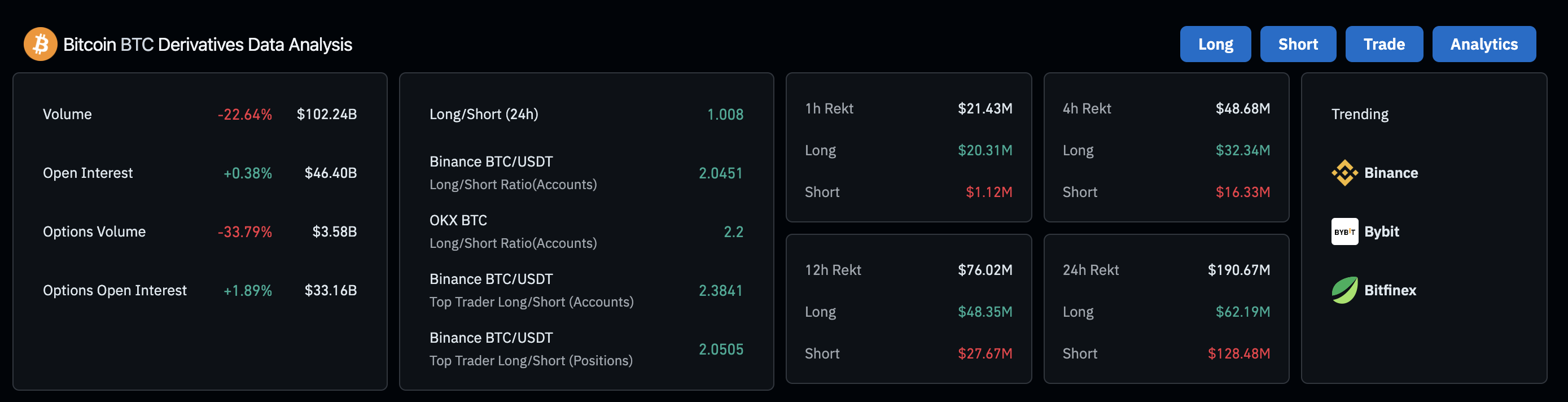

Despite Bitcoin trading below the $85,000 mark, key metrics from the derivatives market suggest a developing bullish momentum. However, trading volumes have seen a significant decline, dropping 22.64% to $102.24 billion. This reduction in volume indicates that speculative activity has cooled off following a period of bearish dominance.

- Bitcoin Open Interest: There has been a notable increase of 0.38% to $46.40 billion, indicating that fresh positions are being opened as Bitcoin approaches a bullish price phase.

Bitcoin Derivative Market Analysis | March 12 | Source: Coinglass

- Options Open Interest: Increased by 1.89% to $33.16 billion, further indicating a new bullish sentiment among traders.

- Long/Short Ratio (24h): Currently at 1.008, which illustrates a nearly balanced market but shows a bullish tilt, especially among retail traders using platforms like Binance and OKX.

Liquidation data also paints a bullish picture; in the last 24 hours, a total of $190.67 million in positions were liquidated, with $128.48 million in shorts being liquidated compared to $62.19 million in longs. This trend depicts a squeezing of bearish positions, indicating an increasing confidence in Bitcoin’s price recovery moving forward.

With the derivatives landscape suggesting heightened optimism, the stage appears set for a potential prolonged rally in Bitcoin’s price as investors respond to both macroeconomic conditions and geopolitical developments.