A Brief Overview of the Cryptocurrency Landscape

The cryptocurrency sector has shown a relatively stable yet mildly volatile pattern over the past 24 hours, with its total market capitalization maintaining a level analogous to that observed on February 14. While leading cryptocurrencies like Bitcoin experience fluctuations, some alternative coins have begun to gain momentum, indicating a diverse and dynamic market environment.

Bitcoin’s Resilient Performance

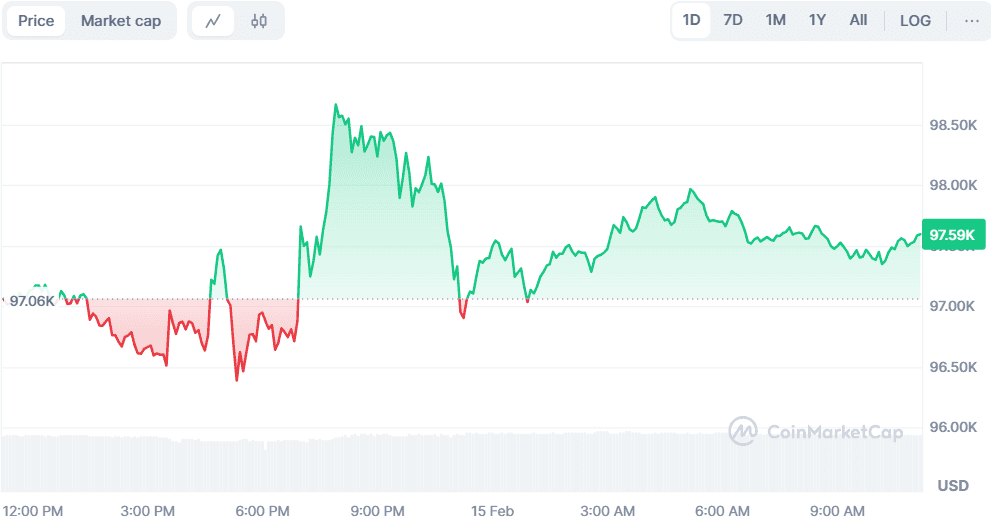

Bitcoin (BTC), the king of cryptocurrencies, has remained robust despite recent market jitters. The asset recently faced challenges, including a notable dip below $95,000 on February 12. This downward movement coincided with the release of inflation data from the US Bureau of Labor Statistics, which was higher than anticipated. As expected, this disappointing report sent ripples across the crypto market, dragging down prices temporarily.

However, the bulls quickly reestablished control, rallying Bitcoin’s price back up to $98,000. As trading progressed, BTC demonstrated resilience, reaching midday highs of approximately $98,700. Currently, Bitcoin is trading around $97,600, reflecting a modest 1% increase within the last 24 hours. This performance sees its market capitalization hovering around an impressive $1.93 trillion, maintaining a dominant position of nearly 59.6% against alternative cryptocurrencies, according to data from CoinMarketCap.

Leading the Charge: Altcoin Highlights

While Bitcoin continues to hold its ground, several alternative coins have captured the spotlight with significant price movements. Among them, Mantra (OM) stands out with a staggering 35% surge, reaching a new all-time high of $7.90 within the last day. This explosive growth highlights the potential for altcoins to outpace Bitcoin during certain market conditions, drawing attention from seasoned traders and newcomers alike.

Another notable performer is Ripple’s XRP, which saw an 8% increase, climbing to a two-week high of $2.82. This surge aligns with the recent decision by the US SEC to consider an application from 21Shares to convert its XRP Trust into an exchange-traded fund (ETF), a development that has stirred up positive sentiment within the XRP community.

A variety of other cryptocurrencies have also experienced positive momentum, with popular names like Chainlink (LINK), Dogecoin (DOGE), and Shiba Inu (SHIB) recording solid gains. Conversely, some well-known tokens such as Ethereum (ETH), Binance Coin (BNB), and Solana (SOL) exhibited minor losses, showcasing the diverse reactions across the market landscape.

Current Market Capitalization Insights

The total market capitalization of all cryptocurrencies currently stands at approximately $3.24 trillion, translating to a minor daily increase of 0.3%. This consistent growth affirms the sector’s ongoing evolution and adaptation, as traders and investors assess market conditions and navigate the flux of price movements across various assets.

Market Dynamics and Investor Sentiment

The cryptocurrency market operates in a delicate balance where external economic factors, regulatory developments, and market sentiments continually intersect to shape trading behaviors. As inflation concerns weigh on traditional markets, cryptocurrencies offer both a hedge and an opportunity for speculative trading, granting crypto users unique avenues for profit and risk management.

The capacity of altcoins such as Mantra and Ripple to outperform Bitcoin during specific trading sessions signals an evolving landscape where diversifying portfolios can lead to unexpected gains. Traders are urged to remain vigilant, regularly assessing the market for new opportunities while also being aware of the potential for volatility inherent in the crypto space.

The Takeaway

As the cryptocurrency sector continues to navigate a complex environment characterized by variable price trajectories, the interplay between Bitcoin and alternative coins emerges as a focal point for traders and investors. Monitoring trends, staying informed about regulatory changes, and understanding market dynamics will undoubtedly remain key strategies in this ever-evolving financial frontier.