The Bitcoin mining industry is on the brink of a major transformation in 2025, with the partnership between the Trump family and Hut 8 alongside Tether’s ambition to become the world’s largest mining company by year-end.

This reshapes the Bitcoin mining sector and opens up strong growth prospects for 2025. However, success will depend on technology, policy, and the ability to adapt to market fluctuations.

Bitcoin Mining Will Hit New Heights in 2025

In a significant announcement, Tether CEO Paolo Ardoino has unveiled plans to deploy 450 MW of mining capacity by the end of 2025, targeting a remarkable 1% of the global hashrate. This ambitious target is underpinned by Tether’s robust financial foundation, boasting a market cap of $157 billion for its USDT stablecoin. Additionally, the company plans to release its Bitcoin Mining Operating System (MOS) as open-source software by Q4 2025, a move that could democratize access to mining for various players.

“Many small and mid-sized businesses that produce their electricity (solar, etc.) will soon start mining with the excess. MOS will make their life easier.” — Paolo Ardoino

Tether’s initiative emerges during turbulent times for the Bitcoin market, as Bitcoin’s hashrate recently plummeted to an 8-month low of 684.48 EH/s, the lowest level since October 2024. A significant adjustment in mining difficulty is anticipated, with estimates suggesting a decrease of 9.5% on June 29, 2025. This drop is occurring amidst geopolitical triggers, notably US military actions in Iran, affecting the broader landscape of Bitcoin mining.

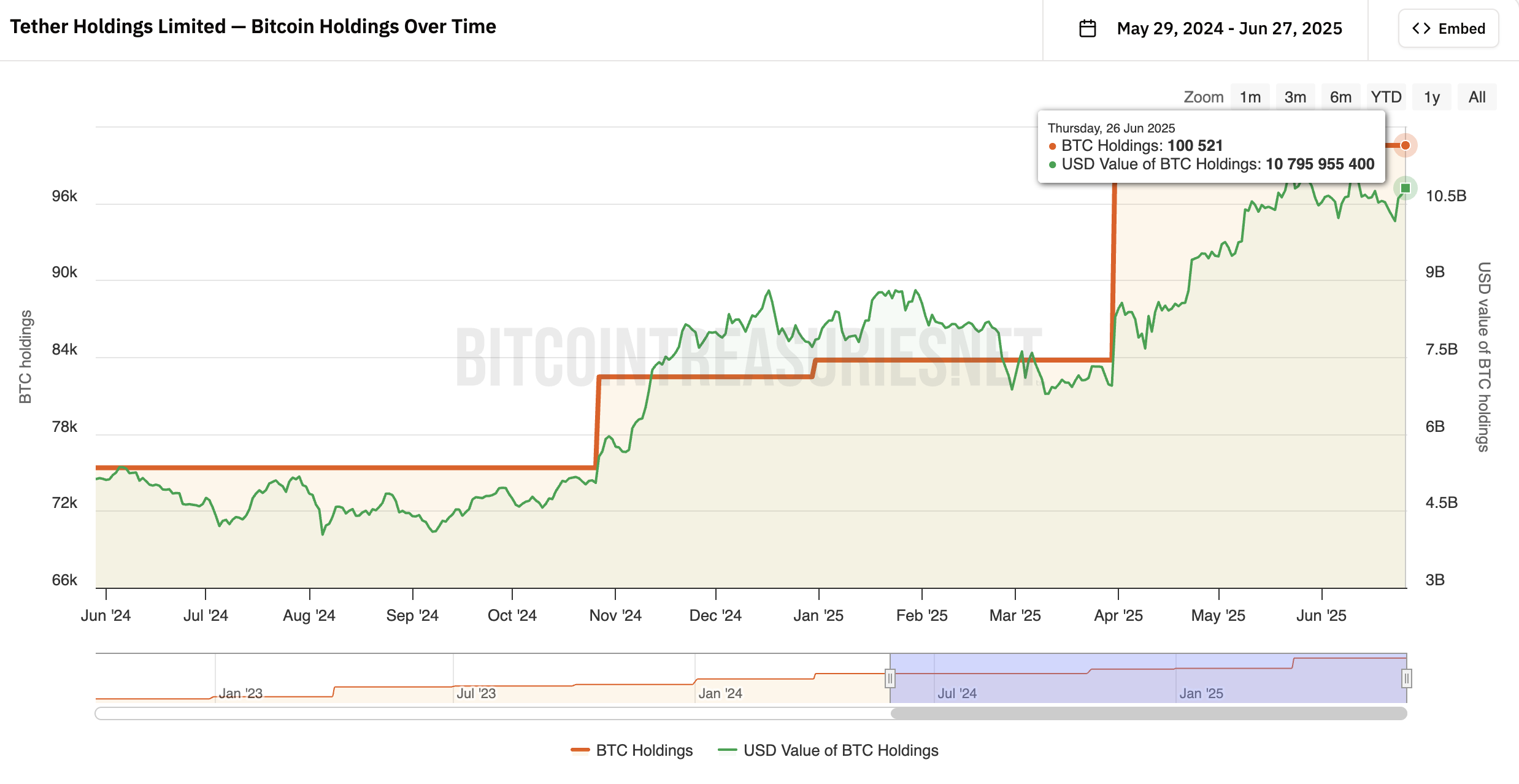

With Tether currently holding over 100,000 Bitcoin valued at approximately $10.8 billion, fierce competition is heating up within the mining sector. This increasing centralization trend poses challenges for individual miners, as larger players leverage their scale to outpace smaller operations.

As market instability rises, many Bitcoin miners are resorting to selling off their stocks to maintain traction. Reports indicate that mining companies are taking proactive steps to manage costs amidst fluctuating prices.

Hut 8 and the Trump Family Partnership

On March 31, 2025, Hut 8, a leading infrastructure mining company, announced an exciting partnership with American Bitcoin, co-founded by Donald Trump Jr. and Eric Trump. This partnership is particularly strategic, leveraging Donald Trump’s support for cryptocurrencies to tap into new pools of capital and innovative technologies. The collaboration could potentially contribute an additional 5-10 EH/s to the global hashrate, a crucial boost considering mining costs have surged over 34% in Q2 2025 due to rising electricity prices.

Advantages and Challenges

From a technological perspective, the combined efforts of Hut 8 and Tether may facilitate a slower reduction in mining difficulty if hashrate levels see a rapid recovery. This could be aided by cutting-edge technologies, such as Hut 8’s optimized cooling systems, which aim to reduce energy costs significantly.

Moreover, the potential re-election of Donald Trump could bring forth crypto-friendly policies, including favorable tax incentives that may further bolster industry growth. Tether is also making strides in sustainability; the company is investing $1 billion in green mining infrastructure in El Salvador, aligning its business model with global sustainability trends.

However, challenges persist. The Energy Information Administration (EIA) highlights that rising industrial electricity demand in the US creates pressure for miners, benefitting large operators like Hut 8 and Tether who can leverage economies of scale to absorb costs more efficiently.

With Bitcoin currently maintaining stability at around $105,000 and the broader US stock market showing signs of decline, the mining industry seems poised for significant opportunities. However, the journey ahead hinges on astute cost management, innovative technological adaptations, and compliance with evolving regulatory frameworks.